Welcome to the Adviser Trends Australia Report, a concise, adviser‑focused update for wealth practices and family offices. We outline how structured investments were implemented across high‑net‑worth (HNW) portfolios in the September quarter, and what’s working now in income, growth, and capital‑protection sleeves.

Key takeaways:

- Paid for Patience: With markets nearing all time highs, Smart‑Entry income notes became a standard playbook—earning ~9–12% p.a. while pre‑agreeing entries ~20% below spot across 3–12M cycles.

- Income with explicit protection (bank hybrid alternative): Fixed‑coupon notes with downside‑protection barriers offering buffers of −40% and 18–24M tenors; average income coupons ~8-9% p.a.

- AUD, risk‑managed global growth: Enhanced/Principal‑Protected Growth in AUD delivered US Tech/AI exposure with averaging entries, early take‑profit or maturity protection; allocations focused on US mega‑cap tech.

- Protected Equity Lending over ASX ETFs: After bringing this solution to Advisers in April 2025, we were overwhelmed by interest. The majority of strategies targeted 100% leveraged exposure to Vanguard's ASX 300 ETF (VAS) with 100% portfolio protection. An added benefit for investors was the upfront prepaid interest deduction - timely ahead of 30 June 2025.

- Alternatives pivot with clearer rules: With private‑credit regulator crackdowns, spreads compressing and multi‑year lock‑ups, advisers used structured investments for comparable yield targets, shorter horizons, better liquidity and greater certainty of outcomes.

- Advisers deployed ~94% AUD issuance keeping global exposures simple to report and supervise.

Trend Snapshot:

- Strategy mix: ~49% Income, ~51% Growth

- Currency: ~94% AUD issuance keeping global exposures simple to report and supervise.

- Income pricing: average coupon ~12.5% p.a.

- Tenor: medians 12–24 months; average ~19 months (Income) vs ~40 months (Growth)

- Protection: most flow around 30–40% downside barriers; Smart‑Entry levels of ~20% below spot.

- Themes/underliers: US mega‑cap tech, consistent Aussie banks, and tax‑optimised strategies over ETFs e.g VAS (Vanguard ASX 300)

For a full detailed view: access the full report here.

Five most common adviser trends:

1) Overvalued Equities: Getting paid for patience

A long list of worries that include tariffs, geopolitics, inflation, policy shifts drove sharp drawdowns in April (~ASX −14%, ~S&P −20%, Nasdaq‑100 −25%) before a rebound to new highs with better breadth. Many clients hesitated then, and are hesitating now at perceived highs.

Solution: Smart‑Entry income note paying ~8–12% p.a. with the ability to buy an asset at a predetermined value, below spot at the end of the term.

“If markets decline, we enter at the smart-entry level whilst retaining enhanced income; if they don’t, you retain the enhanced income.”

2) AUD global growth with risk controls

Advisers expressed long-term views on US tech/AI and opted for global commodity views in AUD to eliminate currency risk. These strategies allowed advisers to play for growth, deploy smaller amounts of capital without sacrificing upside exposure, with no margin calls or lose more than their initial investment.

Solution: Enhanced / Principal‑Protected Growth in AUD. Defensive features were typically added that smoothened entry and exit points, as well as profit taking features.

“Global participation in a local‑currency, with guardrails around timing and downside.”

3) Protected Equity Loans (PEL): “After‑tax, risk‑managed equity exposure”

Reflecting on the end of the financial year period, advisers and accountants are typically on the hunt for leveraged, protected market exposure, particularly if entry points are reasonably attractive. Leverage in the form of Protected Equity Loans also offer the added benefit of upfront interest deductibility - timely ahead of 30 June 2025.

Solution: Protected Equity Loan (PEL) Limited‑recourse loan + 100% portfolio protection on ASX or global names with potential interest deductibility and CGT treatment where eligible.

4) Hybrid alternatives (Australia): Income with pre‑defined protection

As APRA phases out bank hybrids, advisers are rebuilding the income sleeve with transparent defined income and protection that map to client risk budgets via fixed‑coupon notes with deep downside‑protection barriers.

Solution: Fixed Income note with 30–40% downside‑protection barriers (often 18–24 months) to pair income targets with a predefined floor on their preferred basket of equities.

“Defined income and explicit protection let you align yield and risk, with every outcome set upfront — giving you clarity and control that hybrids can’t.”

i) What does “downside-protection barrier” mean?

Capital is secured as long as the reference assets do not breach the ‘downside barrier’ at maturity. If the downside barrier is breached, capital is exposed to the performance of the worst reference asset.

5) Private credit alternatives: yield with explicit rules and shorter horizons

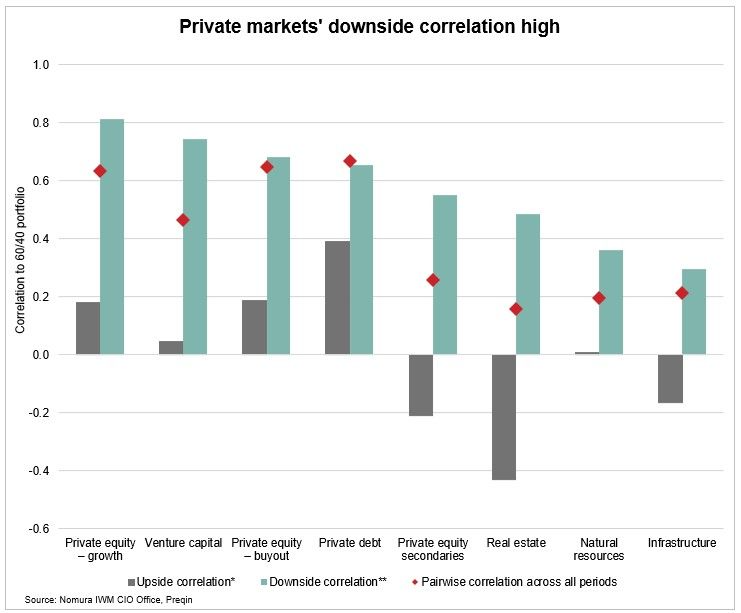

Several alternatives like private equity or private credit show meaningful correlation to global equities, which increases during downturns (See image below). “Adding alts” to a portfolio isn’t a guaranteed fix anymore. The question for every allocation becomes: how does it behave in a drawdown, how liquid is it, and what are the cashflows?

In private credit, regulator crackdowns, spread compression and multi‑year lock‑ups dulled the yield/liquidity trade‑off for some mandates. Structured investments offered comparable yield targets with downside‑protection barriers, shorter tenors (6–24M) and more frequent repricing.

i) What does “more frequent repricing” mean?

Structured investments offered by Stropro typically mature every 6-12 months, letting you reset yields, barriers and entry levels against current rates and volatility. By contrast, private‑credit yields and valuations typically adjust more slowly, and true NAVs can lag in sell‑offs.

What’s working on Stropro is simple: income you can specify, entries you pre‑agree, and growth with explicit protection settings. Defined‑outcome structures turn those into portfolio rules that can be implemented with precision and personalisation for HNW investor portfolios.

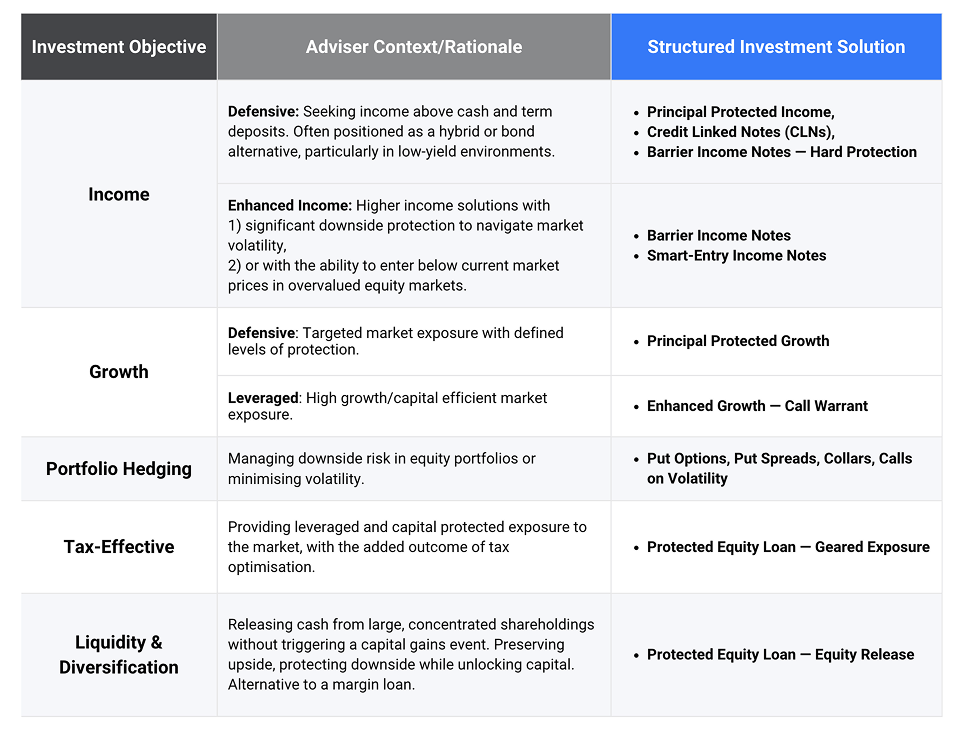

How to use this with clients tomorrow (decision cheatsheet from our investment solutions guide):

How Stropro supports advisers:

Unlock the access, support, and technology required to manage modern portfolios with confidence.

Our process:

- Discovery & Ideation: portfolio fit, risk tolerance, return/income/tax objectives, time horizons, themes.

- Optimisation & Price Tendering: multi‑issuer pricing, basket optimisation, market testing.

- Execution & Compliance: term‑sheet review, AFSL coverage, digital execution, documentation.

- Enhanced Lifecycle Management on our Adviser Hub: monitoring, alerts, corporate actions, structured reporting at client level.

- Integration: connect Stropro to your existing tech stack (Praemium, Netwealth, IPS, Dash, Sharesight, and others).

Important Information:

1. Wholesale Investors only.

2. Subject to credit risk of the issuer.

3. Tax outcomes depend on individual circumstances and applicable tax law, and may be subject to change. Investors should seek independent tax advice regarding CGT deferral and interest deductibility.

Investments made available on the Stropro platform are only available to wholesale, sophisticated or professional investors and their financial advisers. Information is general in nature. Please consider whether the information and investments are suitable for you and your personal circumstances. Stropro Operations Pty Ltd (ABN 28 633 603 399) (Stropro) is a Corporate Authorised Representative (CAR No. 1293257) of Stropro Compliance Pty Ltd (ABN 74 640 214 740, AFSL No. 533443). Stropro Operations Pty Ltd and Stropro Compliance Pty Ltd are subsidiaries of Stropro Technologies Pty Ltd (ABN 80 619 399 932). © 2025.

.png)

.png)

.png)